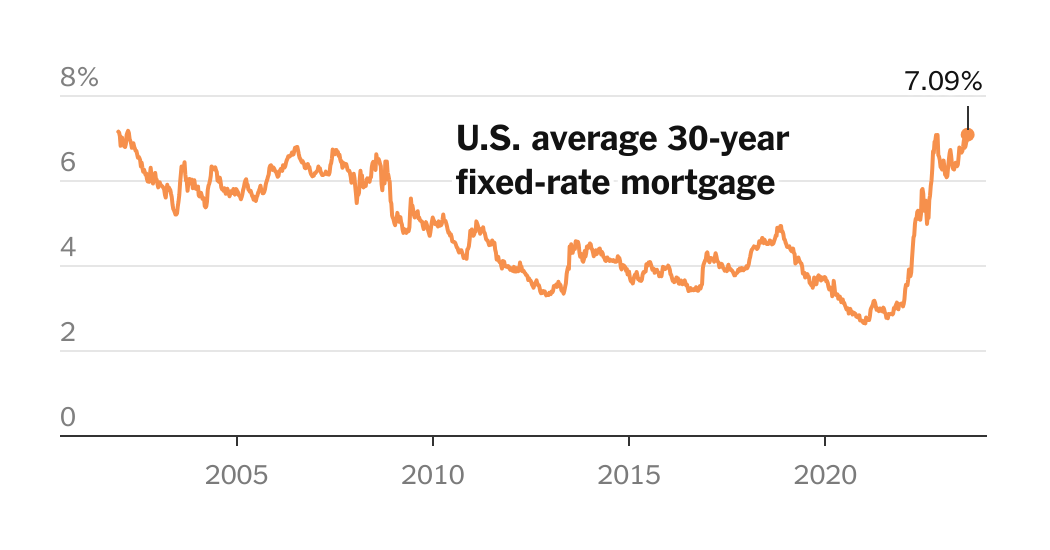

Mortgage rates rose to a 21-year high this week, a jump that will make it harder for buyers to buy homes in a market hampered by rising prices and low inventory.

The average 30-year fixed-rate mortgage — the most popular mortgage in the United States — was 7.09 percent, Freddie Mac said, up from 6.96 percent last week. A year ago, the rate for 30-year-olds was 5.13 percent.

Analysts say they expect mortgage rates to remain high in the near term, and to begin to gradually cool off by the end of the year. The current rate is the highest since April 2002. Since then, homebuyers have enjoyed years of declining rates, which even fell to less than 3 percent at the start of the pandemic.

But with mortgage rates surprisingly high last year, when the Federal Reserve began raising interest rates to rein in rapid inflation, the housing market stagnated, as those with low mortgage rates were unwilling to put their homes up for sale.

In June, existing home sales fell nearly 19 percent from a year earlier, according to the National Association of Realtors. The scarcity of listings has kept home prices high: The median current home price was $410,200 in June, the second-highest since the organization began tracking data in 1999, down only slightly from a high of $413,800 a year earlier.

Experts don’t think the housing market will calm down any time soon. On Tuesday, Goldman Sachs revised up its home price forecast, forecasting a 1.8 percent rise in prices this year and a 3.5 percent jump in 2024. “Affordability remains a drag,” analysts at the bank said in a report, asking fixed on homes.

That’s bad news for potential homebuyers like Kathleen Schmidt, who rents a home in Toms River, NJ, with her husband and two teenage children. She said they were trying to save a 20% down payment on a house close to the village, and that the jump in mortgage rates was discouraging.

“I just felt like I was in a bind: We’ll never be able to buy a house,” said Ms. Schmidt, who owns KMSPR, a public relations firm for authors and publishers.

She added, “It has been my forever dream to own a house one day because it’s something my parents never did.” “We want to leave something for our children.”

Affordability is a continuing challenge for homebuyers, said Jeff Ostrosky, an analyst at personal finance firm Bankrate, and he expected prices to remain high for some time.

“I think buyers are going to have to strap on their chin straps and figure out how to make it work,” he said.

The scarcity of homes for sale has prompted buyers to consider new construction. The Census Bureau reported that new home sales jumped nearly 24 percent in June compared to the same period last year. Home starts, a measure of new home construction, rose about 6 percent in July from a year earlier.

“Builders are making a profit, and their stock margins are bigger than they were a year ago,” said Lawrence Yoon, chief economist for the National Association of Realtors. He added that national builders like KB Home, Lennar, and Toll Brothers would continue to add inventory to make Wall Street happy, but they were focusing more on higher-priced homes.

For homebuyers, finding affordable options can still be challenging. The Federal Reserve raised its policy rate, which supports borrowing costs across the economy, to a 22-year high as it tries to slow inflation by cooling the economy. Although price pressures have eased, with the annual rate of inflation falling from around 9 percent last year to just over 3 percent last month, the recent hike in petrol prices could support the inflation figures.

Central bank officials have suggested that further rate adjustments are possible this year. They expect a rate cut in 2024, but believe it could take several years before rates return to the lower levels that were common before the pandemic.

Mortgage rates generally track the yield on 10-year Treasury notes, which is affected by a variety of factors, including expectations about inflation, Fed actions and how investors react to it all. On Thursday, the 10-year bond yield rose above 4.3 percent for the first time since 2007.

For homebuyers and market watchers, the question remains, how long will mortgage rates stay high?

Mr. Yoon expected rates to slowly start to ease by next spring or until the end of the year, dropping to 6.5 percent, more than double the rate in 2021. But he said the Fed’s fight against inflation and the recent downgrade in the country’s credit rating put pressure on mortgage rates.

“The housing market is in trouble,” he said.