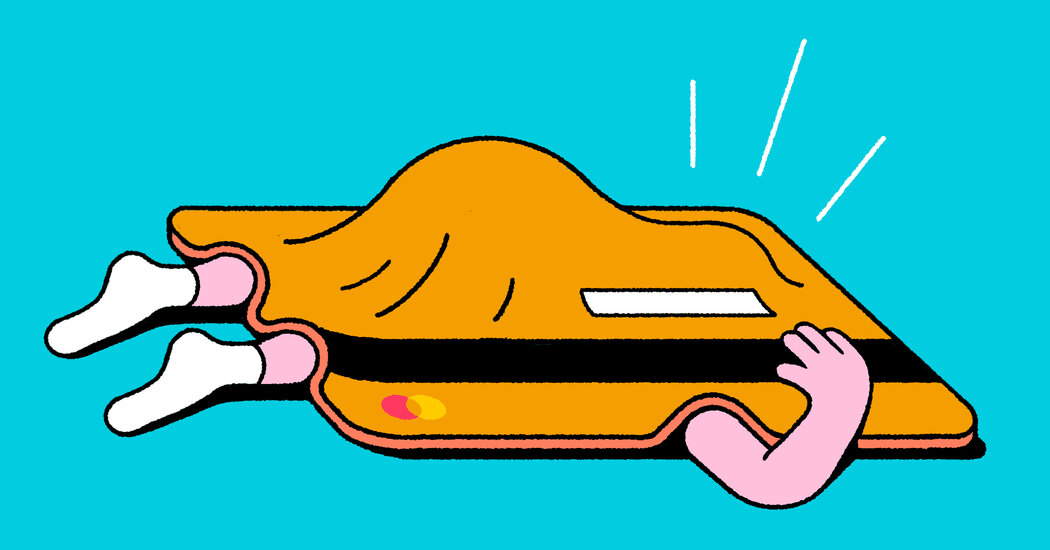

The New York Federal Reserve reported this month that Americans’ credit card balances rose rapidly in the second quarter, to a record high of more than $1 trillion.

Federal Reserve Bank of New York researchers wrote in A blog post, and experienced the largest increase of all types of debt. The researchers found that more than two-thirds of Americans had a credit card in the second quarter, up from 59 percent nearly a decade ago. They noted that card balances were more than 16 percent higher in the second three months of this year than in the year before.

“It’s easy to become overwhelmed with credit card debt, and a trillion dollars tells us that many Americans are making purchases with money they don’t necessarily have,” said Ben Alvarado, executive vice president and director of core banking at California Bank & Trust.

As the prices of goods and services rise, consumers increasingly use credit cards to cover expenses. Young people, in particular, are turning to credit to deal with tighter budgets, according to A.J Modern report From the TransUnion credit bureau. “Everyone uses credit a little bit more to help make ends meet,” said Michelle Ranieri, vice president of U.S. research and advisory at TransUnion.

However, despite higher prices and higher interest rates (a result of the Fed’s battle to tame inflation), Fed researchers said there was “little evidence” so far of widespread financial distress among consumers, who have remained resilient. The Federal Reserve Bank of New York found that card delinquency cases, which were unusually low during the pandemic, have returned to pre-pandemic levels.

The researchers noted that rising balances could stress some borrowers, including those who are due to start paying off their student loans in October after a three-year break.

Credit counselors, who advise cash-strapped borrowers about managing their debt, say they are noticing worrying trends and the reported high balances are not surprising. “We see it happening in real time,” said Jeremy Lark, senior director of program performance and quality assurance at GreenPath Financial Wellness, a national credit counseling agency in Farmington Hills, Michigan. The average card balance was $7,717 on a credit report, the agency said, up from $4,298 in July 2022.

Inquiries from people citing student loans as a reason for inviting them to GreenPath rose 50 percent in July compared to June, the agency reported, adding that it expects another increase in September as loan services begin notifying borrowers of their repayment obligations.

a A recent study A study by the financial services firm Empower found that a third of families with student debt expected their monthly loan payments to be at least $1,000, and many were preparing for “significant” lifestyle and budget changes when repayments began. Those planned adjustments include cutting back on eating out, as well as taking on more credit card debt.

This can be expensive, especially for people who don’t pay their card bill in full each month. The average interest rate charged on cards with balances was approx 22 percent In May, the New York Federal Reserve reported, while second-quarter data from credit bureau TransUnion found that the average card debt per borrower was nearly $6,000. Paying only the minimum monthly payment, it would take about 18 years and nearly $9,500 in interest to pay off the debt, said Ted Rossman, senior industry analyst at Bankrate.

What can consumers do if they are worried about a debt crisis? Borrowers with federal student loans should see if they qualify for income-driven repayment plans, which can lower monthly payments to a more affordable amount. There are many plans, with somewhat confusing criteria. Here’s a guide to those plans, including details of the most recent one, known as Memorizes.

It’s a good idea, Mr. Alvarado said, to review your spending habits and debt. I recommend adding up the number of cards you have noting both their balances and the interest rate you are paying.

There are two common strategies for paying off credit card debt. The first, often preferred by financial planners, involves paying off the card with the highest interest rate first, to save the most money. (Check your card agreement or statement to see what rate you’re paying.) With the second option, you can pay off the card with the lowest balance first, to get to success quickly. Whichever method you prefer, transfer any extra money toward the target card and make minimal payments on the others, so you don’t incur late fees or hurt your credit. Once you’ve paid off one balance, put the extra cash into the next card, and so on.

After you pay off the credit card, it can help your credit balance to leave the account open while using it at a minimum. The more unused credit you have, the better the effect on your credit score.

Here are some questions and answers about credit card debt:

Can I transfer my card balance to a new card at a lower rate?

Balance transfer offers at zero percent interest are still available, Bankrate’s Rossman said, and people with FICO credit scores of 670 or higher generally qualify. (average FICO score Since 2021 it’s been 716.) But before you open a new card, he said, make sure you can finish paying off the transferred balance in the allotted time—usually 15 to 18 months. You’ll typically pay a fee of 3 to 5 percent of the balance transferred to the new card.

Should I consider consolidating my card debt with a personal loan?

More borrowers are using personal loans, available from online or “fintech” lenders as well as banks and credit unions, as a way to pay off high-interest credit cards. But the benefits may be short-lived unless borrowers limit card spending after consolidation, according to Separate data from TransUnion. Personal loans, like credit cards, are “unsecured” — no collateral is at stake, as is the case with a car or home loan — but they do have fixed monthly payments. People who used personal loans to consolidate card debt saw a 57 percent decrease in their card balances on average. But 18 months later, card balances are up near their previous levels, TransUnion found, based on data from April 2021 to September 2022.

Can I use credit cards to pay off my student loans?

In general, no, said financial aid expert Mark Kantrowitz. Neither the federal government nor private student loan lenders allow this, he said, because card issuers charge them a fee, and there are delays in receiving the money. He said it was a bad idea anyway. For one thing, credit cards usually charge much higher interest rates than student loans.