why does it matter

The move will provide Arm’s parent company, SoftBank, with more capital to invest more in startups. In a meeting with investors and analysts, SoftBank CEO Masayoshi Son said the company is ready to go “on the offensive” in the field of artificial intelligence.

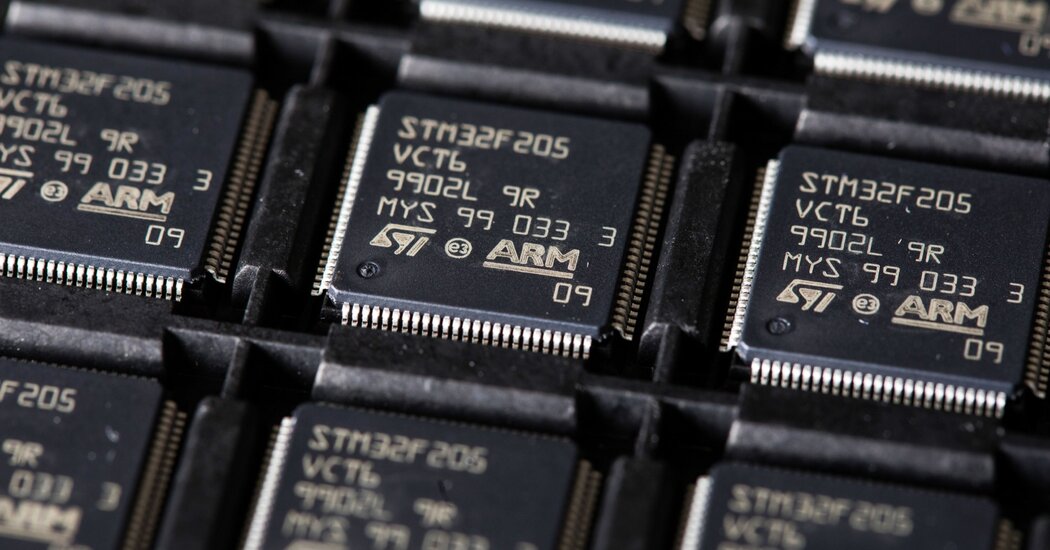

In the filing, Arm said more than 30 billion Arm chips manufactured were shipped in the last fiscal year. SoftBank will remain the controlling shareholder of Arm.

background

Arm, 33, develops and licenses schematics for microprocessors that other companies turn into chips. Its energy-efficient technology has played a major role in fueling the cell phone boom, including every iPhone Apple has sold since 2007.

But Arm technology is also found in countless other products, including home appliances, automobiles, and industrial equipment. The company estimates that more than 250 billion Arm-based chips have been sold.

Arm was a public company until 2016, when SoftBank bought it for $32 billion. Nvidia made its bid to buy the company in September 2020, but faced vocal opposition from regulators and some major chip companies.

SoftBank has suffered huge losses since that failed acquisition, reporting a loss of $3.3 billion in the first quarter of this year. The Vision Fund, the technology investment arm of SoftBank, noted a net loss of $3.3 billion, but an investment gain of $1.1 billion in the second quarter, after a loss of $23.1 billion a year earlier.

What then

Filing an IPO means Arm can start to gauge investor interest, which will be crucial to selling the shares. The company will still need to say how much it plans to increase in bid, what valuation it is seeking, and something it will do near the sale.

Renee Haas, who has served as Arm’s CEO since February 2022, has pushed the company to move into more profitable areas, including data center servers operated by companies like Amazon. How good the effort is, as well as the names of any high-profile investors and potential changes to Arm’s business model to generate more revenue is likely to be a major topic for investors studying its prospectus.